The Cashless Revolution : In the heart of South Asia, a quiet revolution is unfolding across Pakistan’s financial landscape. The nation once dominated by cash transactions is rapidly embracing digital financial technology, fundamentally changing how millions transact, save, and manage money. With over 118 million internet users representing 54% of the population and mobile penetration exceeding 77%, Pakistan has created fertile ground for fintech innovation . The country’s journey toward a cashless ecosystem represents one of the most significant socioeconomic shifts in its recent history, touching everyone from urban professionals to rural shopkeepers, and from government agencies to small-scale entrepreneurs.

The State Bank of Pakistan (SBP) has emerged as a driving force behind this transformation, implementing strategic policies and launching infrastructure projects aimed at accelerating digital financial inclusion. Their ambitious goal to digitize all government payments by 2026 signals a determined push toward formalizing the economy and expanding financial access to previously excluded populations . This comprehensive transition from cash to digital payments is not merely about technological adoption—it represents a fundamental restructuring of economic interactions that promises greater transparency, efficiency, and inclusion across Pakistani society.

Table of Contents

The Foundation: Pakistan’s Fintech Landscape

Historical Context and Early Beginnings

Pakistan’s fintech journey began in 2009 with the introduction of Easypaisa, a mobile-based financial service launched by a telecom company that initially focused on money transfers . This pioneering platform broke new ground in a market where traditional banking services reached only a small fraction of the population. For the first time, millions of Pakistanis could transfer money without visiting a bank branch, fundamentally changing their relationship with financial services. The success of Easypaisa demonstrated the potential for mobile-based financial solutions in a country with limited traditional banking infrastructure but growing mobile phone penetration.

The early success of mobile money services revealed several key insights about the Pakistani market: consumers were eager for convenient financial solutions, mobile technology could effectively deliver these services, and agent networks could successfully substitute for physical bank branches in many contexts. These learnings paved the way for subsequent innovations and established a foundation upon which today’s more sophisticated fintech ecosystem could be built. The model proved particularly effective in rural areas where banking infrastructure was sparse but mobile networks had reached significant coverage.

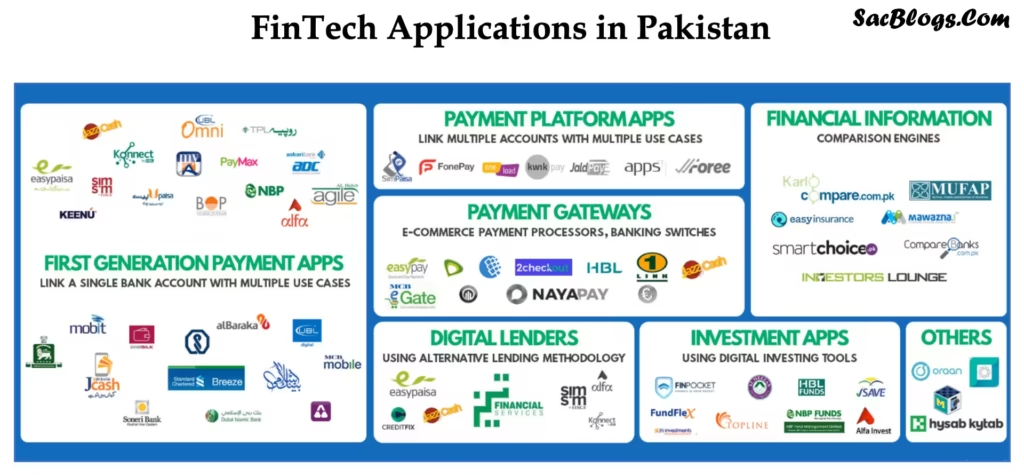

Current Market Structure and Key Players

Today, Pakistan’s fintech ecosystem has evolved into a dynamic marketplace with diverse participants ranging from telecom-led mobile money services to digital-only banks and specialized payment platforms. JazzCash and Easypaisa maintain significant market presence, each boasting over 15 million users and offering expanded services beyond simple money transfers to include bill payments, mobile top-ups, and limited savings products . These platforms have become household names, particularly in urban and semi-urban areas, and continue to onboard new users through extensive agent networks and continuous product innovation.

The landscape has further diversified with the emergence of neobanks—digital-only banking platforms that operate without physical branches . These fintech startups allow users to open bank accounts, make instant payments, transfer money, pay bills, and create virtual cards entirely through mobile applications. Meanwhile, the State Bank of Pakistan has significantly influenced the ecosystem through the launch of Raast, the country’s first instant payment system, which enables seamless transactions between individuals, businesses, and government entities . This diversification of players has created a competitive environment that drives innovation while expanding financial access to previously underserved segments of the population.

Driving Forces: Catalysts of Pakistan’s Cashless Transition

Government Initiatives and Regulatory Support

The Pakistani government has positioned digital financial inclusion as a cornerstone of its economic policy, implementing a multi-pronged strategy to accelerate cashless adoption. The centerpiece of this effort is the ambitious plan to digitize all government payments by 2026, including salaries, pensions, and social welfare disbursements . This commitment represents not just a technological shift but a fundamental reengineering of public financial flows that will inevitably influence broader economic behavior. When citizens receive regular government payments directly into digital accounts, they naturally become more comfortable with and integrated into the formal financial system.

The State Bank of Pakistan has complemented these efforts through strategic regulatory reforms, including the implementation of Regulations for Mobile Banking Interoperability and the creation of the Third Party Service Provider (TPSP) License that facilitates fintech innovation . Additionally, the government has established a Rs 3.5 billion merchant subsidy program to incentivize small businesses to adopt digital payment solutions by reimbursing transaction costs . These policy measures collectively create an enabling environment for digital payments while addressing specific barriers to adoption among both consumers and merchants.

Technological Infrastructure and Demographic Shifts

Pakistan’s rapid technological advancement has created unprecedented opportunities for fintech expansion. With 143 million broadband subscribers and 193 million cellular subscribers, the country has built a digital infrastructure that can support widespread fintech adoption . This connectivity foundation, combined with increasing smartphone penetration, has made digital financial services accessible to segments of the population that traditional banking never reached. The infrastructure enables not just basic transactions but increasingly sophisticated financial products and services.

Demographic trends further accelerate this transition, as over 60% of Pakistan’s population is under 30, creating a natural constituency for digital financial services . This young, tech-savvy generation displays less attachment to cash than their elders and greater willingness to adopt digital solutions for everyday needs. Meanwhile, the COVID-19 pandemic served as an unexpected catalyst, accelerating contactless transaction adoption globally and similarly influencing behavior in Pakistan . These technological and demographic forces combine to create powerful momentum behind the cashless transition, particularly in urban areas where digital infrastructure is most developed.

Raast: The Digital Payments Revolution

System Overview and Key Features

Raast, meaning “direct way” in Urdu, represents the cornerstone of Pakistan’s digital payments infrastructure . Launched by the State Bank of Pakistan, this instant payment system enables individuals, businesses, and government entities to transfer money instantly and securely 24/7 using simple identifiers like mobile numbers or CNIC instead of complex bank account details. The system eliminates transaction costs that often deter small-value digital payments, making it economically viable for everyday transactions. By providing a seamless, accessible, and cost-effective payment channel, Raast addresses critical barriers that have historically limited digital payment adoption in Pakistan.

The technological architecture of Raast incorporates high-level encryption and operates under State Bank oversight, creating a secure environment that builds user confidence . Unlike informal money channels or some private payment platforms, every Raast transaction is traceable, creating accountability that helps combat fraud and corruption while protecting users. This combination of accessibility, security, and transparency positions Raast as a potentially transformative tool not just for payments but for broader economic formalization and governance improvements.

Impact and Adoption Metrics

Since its launch in 2021, Raast has achieved remarkable penetration, currently serving 47 million users and processing transaction volumes in nine days that previously required a full year . The system has processed over 892 million transactions worth approximately Rs 20 trillion ($72 billion), demonstrating both scale and user acceptance . These numbers reflect rapid adoption that exceeds initial projections and suggests strong product-market fit. The system’s growth trajectory indicates its potential to become the dominant payment infrastructure for both person-to-person and person-to-business transactions nationwide.

The system’s impact extends beyond raw transaction numbers, influencing behavior across sectors including education, healthcare, agriculture, and social welfare . Schools and universities are testing digital fee collection through Raast, eliminating manual challans and bank queues. Hospitals and clinics are adopting the system for patient billing, improving record accuracy. Farmers now receive subsidies and crop payments directly into bank accounts, ensuring funds reach intended recipients without intermediary delays or deductions. This sector-wide adoption demonstrates Raast’s versatility and its potential to transform economic interactions beyond simple retail payments.

Transformative Effects: How Cashless Payments Are Changing Everyday Life

For Consumers: Convenience and Financial Inclusion

The rise of cashless payments has fundamentally reshaped the consumer experience across Pakistan, particularly for urban residents. Everyday activities like paying utility bills, transferring money to family, or purchasing goods have been transformed from time-consuming errands requiring physical travel to instantaneous digital transactions. This convenience factor proves particularly valuable for Pakistan’s large youth population, who increasingly expect to manage their lives through mobile devices . The ability to conduct financial transactions anytime, anywhere represents a significant quality-of-life improvement for millions.

Perhaps more significantly, digital payments are expanding financial inclusion to segments of the population traditionally excluded from formal banking. The World Bank estimates approximately 100 million adults in Pakistan lack awareness of regulated financial services, representing 5% of the world’s 2 billion unbanked people . Fintech platforms, particularly mobile money services, are bridging this gap by offering basic financial services through SIM applications rather than traditional bank accounts. This approach has proven particularly effective in rural areas where banking infrastructure remains limited but mobile networks have achieved significant penetration.

For Businesses: Efficiency and Formalization

Small and medium enterprises are experiencing transformative benefits from Pakistan’s cashless shift. Digital payments reduce cash handling costs, minimize security risks, and create transparent transaction records that facilitate accounting and tax compliance. The government’s Rs 3.5 billion merchant subsidy program further incentivizes this transition by reimbursing transaction costs for small businesses adopting Raast QR payments . This financial support helps overcome initial resistance from merchants concerned about eating into narrow profit margins with transaction fees.

The movement toward digital payments also supports broader economic formalization, bringing transactions that previously occurred in the informal economy into the regulated financial system. This transition generates data trails that help businesses establish credit histories, potentially improving their access to formal financing. For freelancers and service providers, digital platforms enable direct receipt of payments from international clients without expensive intermediary services, supporting Pakistan’s growing participation in the global digital economy. These changes collectively contribute to a more transparent, efficient, and integrated business environment.

For Government: Transparency and Policy Effectiveness

The government’s push toward digital payments serves multiple policy objectives simultaneously, from fiscal management to social welfare improvement. Digitizing government payments—including salaries, pensions, and social transfers—reduces leakage and ensures funds reach intended recipients without intermediary deductions . The traceability of digital transactions creates accountability that helps combat corruption while providing valuable data for policy planning and evaluation. These benefits prove particularly valuable for social safety net programs like Ehsaas, where ensuring efficient benefit delivery to vulnerable populations remains a priority.

From a fiscal perspective, digital transaction trails help expand Pakistan’s narrow tax base by bringing economic activity from the informal sector into the taxable domain . Finance Minister Muhammad Aurangzeb has explicitly framed the cashless transition as “a practical necessity for long-term fiscal resilience, competitiveness and inclusive growth” . This documentation of economic activity addresses a critical challenge that has constrained Pakistan’s public finances for decades, potentially generating additional revenue without rate increases by broadening the tax base to include previously undocumented transactions.

Challenges and Hurdles in the Path to Cashless

Infrastructure and Access Barriers

Despite significant progress, Pakistan faces persistent infrastructure challenges that complicate its cashless ambitions. Nationwide internet blackouts periodically disrupt digital services, highlighting the fragility of underlying connectivity infrastructure . These service interruptions undermine user confidence in digital payment systems, particularly for time-sensitive transactions. Beyond connectivity issues, the inconsistent quality of broadband and mobile network services in remote and underdeveloped regions creates a geographic digital divide that limits financial inclusion objectives . Without reliable digital infrastructure, expanding electronic transactions beyond major urban centers remains challenging.

The absence of global payment platforms like PayPal further constrains Pakistan’s digital payment ecosystem, particularly for freelancers and businesses seeking to participate in the global digital economy . This limitation not only inconveniences individual users but potentially hampers Pakistan’s ability to fully leverage its competitive advantages in sectors like IT services and freelancing. Addressing these infrastructure gaps requires coordinated investment between public and private sectors, with particular attention to connectivity reliability in rural areas where adoption barriers are highest.

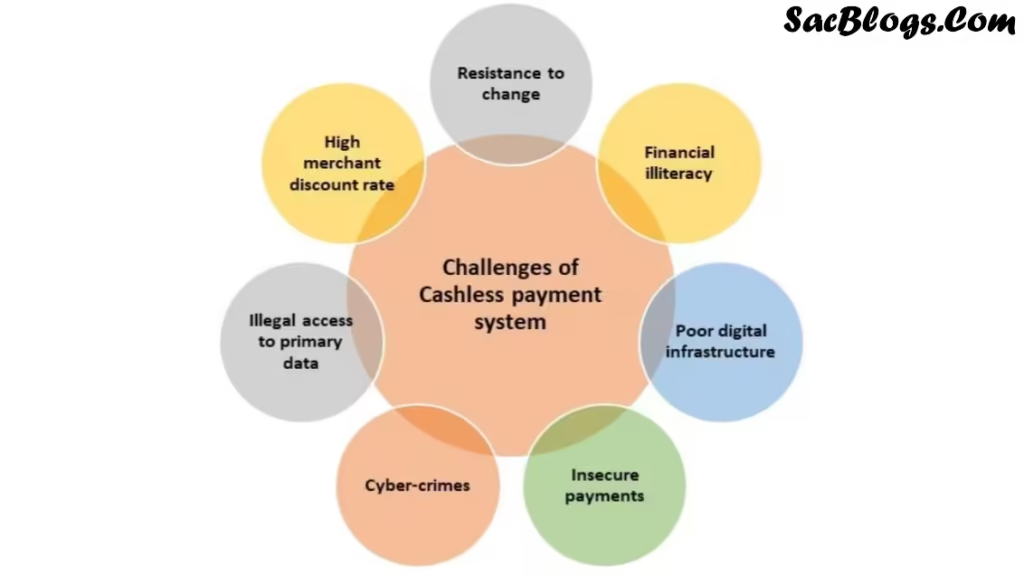

Behavioral and Cultural Resistance

Cultural preferences and behavioral patterns present significant, though often underestimated, barriers to cashless adoption. Pakistan maintains a predominantly cash-based cultural economy, with many consumers expressing skepticism toward digital payment methods . This preference stems from various factors including familiarity, perceived control, and longstanding habits that prove resistant to change. A survey by the State Bank of Pakistan revealed that basic financial literacy is possessed by only 23% of the population, further complicating digital financial service adoption . Without understanding basic financial concepts, consumers understandably hesitate to embrace unfamiliar digital payment systems.

Trust deficits present additional behavioral hurdles, with significant portions of the population expressing skepticism about digital payments driven by fears of government surveillance and data misuse . These concerns are particularly pronounced in a country where data privacy laws remain underdeveloped and enforcement mechanisms are limited. Overcoming these behavioral barriers requires not just technical solutions but comprehensive approaches that address underlying anxieties while demonstrating the tangible benefits of digital payments for everyday financial management.

Financial Exclusion and Literacy Gaps

Pakistan faces significant financial exclusion challenges that necessarily precede and complicate digital payment adoption. Despite 80% of financial services being provided by the banking sector, they serve only 15% of the population, indicating extremely limited penetration of formal financial services . This exclusion disproportionately affects specific demographic groups, with rural populations—especially women—experiencing the highest levels of financial marginalization . These gaps create a scenario where many Pakistanis would need to transition first from financial exclusion to basic financial inclusion before embracing digital payments.

The country’s financial inclusion status ranks 16th out of 26 countries in a Brookings report, highlighting the scale of this challenge . Addressing these gaps requires coordinated action across multiple dimensions, from expanding physical access to financial services in rural areas to developing products specifically designed for low-income and financially inexperienced consumers. Beyond access, financial literacy initiatives must help consumers understand both basic financial concepts and the specific functionalities of digital payment platforms, building confidence through education and familiarization.

The Road Ahead: Pakistan’s Fintech Future in 2026 and Beyond

Short-Term Projections and Policy Initiatives

The Pakistani government has established clear short-term targets to accelerate the cashless transition, with multiple sources confirming plans to digitize all government payments by June 2026 . This comprehensive digitization encompasses federal, provincial, and local government transactions, including salaries, pensions, and social welfare disbursements. Prime Minister Shehbaz Sharif has personally directed provincial governments to cooperate fully with the center to implement this “cashless” system, indicating high-level political commitment . This top-down approach creates implementation pressure that may help overcome bureaucratic resistance.

Complementing these government payment initiatives, the State Bank of Pakistan is taking parallel steps to simplify digital payments for traders and small businesses through expanded QR-code acceptance and streamlined merchant onboarding processes . The central bank has also ordered the doubling of key digital economy targets, including mobile-based payments, QR code adoption, and overall transaction volumes . These ambitious targets signal regulatory determination to accelerate adoption while creating concrete metrics against which progress can be measured. The coming years will likely see additional policy measures designed to create both incentives for digital payment adoption and disincentives for large cash transactions.

Emerging Trends and Future Possibilities

Several emerging trends suggest continued fintech innovation beyond the current payment focus. Artificial intelligence is increasingly being integrated into financial services, as demonstrated by partnerships like the one between Begini and Bank of Punjab to deliver AI-powered behavioral analytics for credit assessment . Such applications could revolutionize credit access for underserved populations by using alternative data for risk assessment beyond traditional metrics. Similarly, blockchain technology continues to attract attention despite regulatory restrictions on cryptocurrencies, with the government approving establishment of the Pakistan Digital Assets Authority to regulate blockchain-based financial infrastructure .

The digital banking segment appears poised for significant expansion, with the State Bank of Pakistan licensing new digital banks that could further accelerate cashless adoption . These institutions potentially offer more sophisticated financial products than current mobile money platforms, potentially bridging the gap between basic payment services and comprehensive financial management. As the ecosystem matures, specialized fintech solutions will likely emerge targeting specific sectors like agriculture, manufacturing, and education, moving beyond generic payment platforms to vertically integrated financial solutions addressing industry-specific needs and pain points.

Conclusion: Balancing Innovation and Inclusion in Pakistan’s Fintech Journey

Pakistan’s journey toward a cashless society represents one of the most significant socioeconomic transformations in the country’s recent history. The ambitious government target to digitize all public payments by 2026 creates a firm deadline that concentrates policy attention and implementation efforts . The remarkable growth of platforms like Raast, which now serves 47 million users and processes in nine days what previously took a full year, demonstrates both the feasibility and public receptivity of this transition . These developments suggest Pakistan is reaching a tipping point where digital payments could soon become the norm rather than the exception for many economic interactions.

Yet true success will require balancing technological innovation with thoughtful inclusion, ensuring the cashless transition benefits all Pakistanis rather than just urban elites. As one analysis notes, “a cashless economy should not just be about replacing cash with digital tools. It must aim to create an inclusive, secure, and transparent financial system that benefits all segments of society” . Achieving this balance necessitates addressing infrastructure gaps in rural areas, building trust through security and privacy protections, and designing intuitive solutions for populations with limited financial or digital literacy. With careful planning and execution, Pakistan’s fintech revolution could potentially deliver not just convenient payments but broader economic participation, reduced corruption, and sustainable, inclusive growth that benefits millions currently at the economic margins.

For More Related Posts : www.sacblogs.com

Frequently Asked Questions About Pakistan’s Cashless Transition

1. What is Pakistan’s timeline for going completely cashless?

Pakistan has announced plans to digitize all government payments including federal, provincial, and local transactions such as salaries, pensions, and subsidies by June 2026 . While this doesn’t represent a completely cashless society, it marks a significant milestone in the transition. Full cashless adoption across all sectors will likely take additional years beyond this initial target.

2. How is the Raast system transforming digital payments in Pakistan?

Raast is Pakistan’s first instant payment system, allowing users to transfer money 24/7 using simple identifiers like mobile numbers instead of bank account details . The system processes transactions within seconds without charges, has already attracted 47 million users, and is projected to become the backbone for all government payments by 2026.

3. What are the main challenges preventing Pakistan from going cashless?

Key challenges include: cultural resistance to digital payments, unreliable digital infrastructure (especially in rural areas), limited financial literacy (possessed by only 23% of the population), cybersecurity concerns, and the large informal economy that prefers cash transactions .

4. How will small businesses benefit from Pakistan’s cashless transition?

Small businesses benefit through reduced cash handling costs, improved security, and access to formal financial services. The government is supporting this transition through a Rs 3.5 billion subsidy program that reimburses transaction costs for merchants adopting Raast QR payments .

5. What percentage of Pakistan’s population currently uses digital payments?

While exact figures vary, the State Bank of Pakistan reports that 88% of retail transactions are now conducted digitally . However, digital payments still account for only 0.2% of Pakistan’s 100 billion annual transactions by volume, indicating significant growth potential .

6. How is financial inclusion improving through fintech in Pakistan?

Fintech platforms, particularly mobile wallets and branchless banking, are expanding access to financial services for underserved populations. The country aims to increase adult financial inclusion from the current 64% to 75% by 2028, with fintech playing a crucial role in achieving this target .

7. What role does the youth population play in Pakistan’s fintech expansion?

With over 60% of Pakistan’s population under 30, the country has a natural constituency for digital financial services . This tech-savvy demographic demonstrates less attachment to cash and greater willingness to adopt digital solutions, accelerating fintech adoption particularly in urban areas.

8. Are digital payments secure in Pakistan?

The State Bank of Pakistan has implemented security measures including high-level encryption for systems like Raast . However, cybersecurity remains a legitimate concern as digital transactions increase. The government is working to strengthen consumer protection laws and enforcement mechanisms to address these risks .

9. What incentives is the government offering to promote digital payments?

The government is implementing both incentives and disincentives, including subsidies for merchants adopting digital payments, potential tax benefits for digital transactions, and restrictions on large cash payments in selected economic sectors .

10. How does Pakistan’s fintech growth compare to regional neighbors like India?

Pakistan’s digital payments sector is growing rapidly but still lags behind regional leaders. While digital payments account for only 0.2% of Pakistan’s transaction volume, this share ranges from 1.5% to 7% in peer countries like India, China, Thailand, and South Korea . Pakistan’s Raast system is inspired by India’s successful UPI model .

1 thought on “The Cashless Revolution – How Fintech is Reshaping Everyday Life in Pakistan 2026”