The Asia-Pacific region is leading a financial transformation, emerging as the global epicenter for fintech innovation and cashless adoption. With the market valued at approximately USD 72 billion in 2024 and projected to expand at a compound annual growth rate (CAGR) of 20-25% over the coming years, the shift towards digital finance is accelerating at an unprecedented pace .

By 2026, this revolution is set to redefine the very fabric of economic interaction, driven by a convergence of cutting-edge technology, supportive government policies, and a profound shift in consumer behavior. This article explores the top 10 fintech trends that will power Asia’s relentless march toward a cashless future in 2026 and beyond, offering a comprehensive outlook on the forces set to reshape how millions save, spend, and manage their money.

Table of Contents

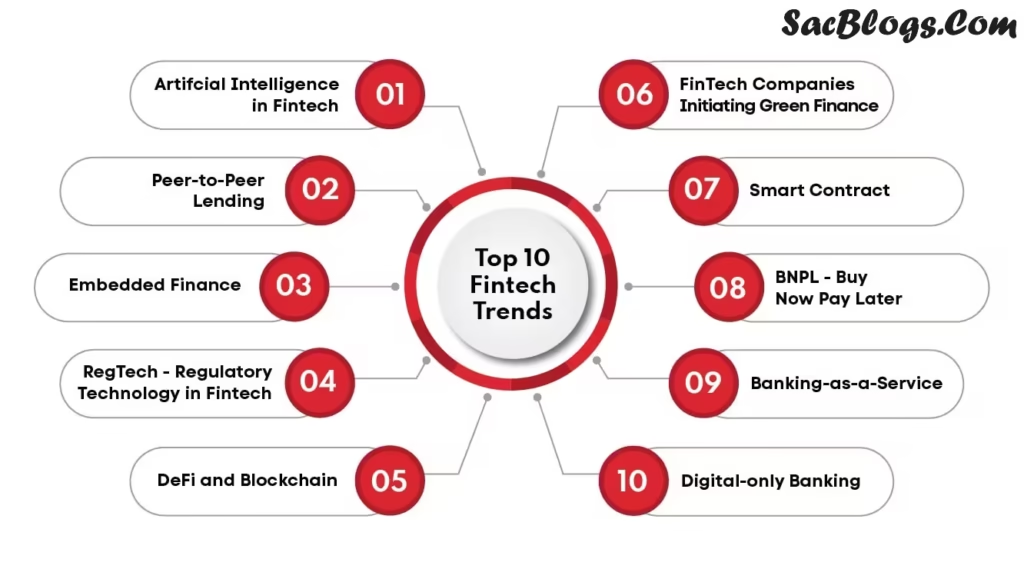

The Top 10 Fintech Trends Shaping 2026

1. AI-Powered Hyper-Personalization and Fraud Detection

Artificial Intelligence is evolving from a backend tool to the core of the consumer banking experience. In 2026, AI will enable a level of hyper-personalization that makes financial services feel tailor-made. Beyond suggesting products, AI will use predictive analytics to anticipate financial needs, offer timely spending advice, and automate savings.

Crucially, this same technology will be the first line of defense against fraud. Deep learning systems will analyze vast datasets in real-time to identify subtle, anomalous patterns indicative of fraudulent activity, making transactions safer than ever before . From AI chatbots handling customer service to sophisticated risk management, AI will be the invisible engine of the cashless ecosystem.

2. The Interconnection of Real-Time Payment Systems

The future of cashless payments lies not in isolated national systems, but in their seamless interconnection. Initiatives like the ASEAN Payment Connectivity project are pioneering this frontier, linking real-time payment systems such as Thailand’s PromptPay, Singapore’s PayNow, and Malaysia’s DuitNow . This trend will mature significantly by 2026.

The recent establishment of Nexus Global Payments (NGP), a multilateral gateway, is a key development. Rather than building complex bilateral links between every country, NGP allows a payment system to connect once to reach all other networks, making cross-border payments as easy as sending a domestic text message . This will be a game-changer for regional trade, tourism, and remittances.

3. The Proliferation of Super Apps and Embedded Finance

The concept of a standalone banking app is becoming obsolete. Instead, consumers are turning to “super apps”—all-in-one platforms that blend social interaction, e-commerce, travel bookings, and deeply embedded financial services . In 2026, the line between financial and non-financial services will blur further.

Embedded finance allows users to access loans at the point of sale, buy insurance when booking a trip, or make investments without ever leaving their preferred app ecosystem. This seamless integration offers unparalleled convenience, driving higher adoption of cashless tools by meeting users within their daily digital routines, rather than forcing them into a separate banking environment.

4. National Digital Currencies (CBDCs) Gain Traction

Central Bank Digital Currencies (CBDCs) are transitioning from pilot projects to active components of the financial landscape. China is at the forefront with its Digital Currency Electronic Payment (DCEP), also known as the digital Yuan . By 2026, we can expect other major Asian economies to advance their own CBDC initiatives.

These state-backed digital currencies aim to reduce reliance on cash, lower transaction costs for businesses, and improve the efficiency of monetary policy. Furthermore, CBDCs offer a secure and stable alternative to private cryptocurrencies for everyday transactions, adding a new, trusted layer to the cashless infrastructure .

5. Blockchain and Stablecoins for Efficient Cross-Border Payments

While CBDCs evolve, the underlying technology of blockchain and regulated stablecoins will address one of the most persistent challenges in finance: costly and slow cross-border payments. Hong Kong’s passage of the Stablecoins Ordinance in 2025 establishes a comprehensive regulatory framework, positioning it as a leader in this space .

By 2026, blockchain-based settlements are expected to become more common, enabling businesses to move money across borders with greater speed, transparency, and lower fees than traditional correspondent banking. These innovations will be particularly transformative for the millions of migrant workers in Asia who rely on remittances.

6. Biometric Authentication for Frictionless Security

As cashless transactions grow, so does the need for security that doesn’t sacrifice convenience. Passwords and PINs are being replaced by biometric authentication. The use of fingerprint scans, facial recognition, and even voice authentication will become standard for verifying high-value transactions and accessing financial apps .

This trend perfectly encapsulates the dual goal of the cashless revolution: making payments utterly seamless while ensuring they are incredibly secure. By 2026, the act of paying may be as simple as a glance at your phone, with advanced biometrics working in the background to ensure that you, and only you, can authorize the transaction.

7. Revolutionizing InsurTech and WealthTech

The cashless revolution extends beyond payments to how people protect and grow their wealth. InsurTech is using technology to offer customized, on-demand insurance products, with claims processing streamlined through AI and IoT devices . Similarly, WealthTech is democratizing investment through digital platforms and robo-advisors, making wealth management services accessible to a broader audience beyond the affluent .

These sectors are experiencing rapid growth as a newly empowered middle class in emerging Asian economies seeks more sophisticated and accessible financial products, all integrated into the digital ecosystems they already use.

8. Open Banking and API-Driven Ecosystems

Open banking, fueled by Application Programming Interfaces (APIs), is breaking down the walls of traditional finance. Regulators in many Asian markets are encouraging this shift, which allows third-party developers to build applications and services around financial institutions .

This creates a more competitive and innovative landscape. By 2026, consumers can expect to use apps that aggregate their financial data from multiple banks and fintechs, providing a unified view of their finances and enabling them to access the best products from a single, user-friendly dashboard.

9. Cloud-Native Infrastructure for Scalability and Resilience

To support the massive data and transaction loads of a cashless society, fintechs and traditional banks are ditching legacy systems for cloud-native infrastructure . Cloud-based platforms offer superior scalability, allowing services to expand seamlessly during peak demand. They also enhance security and reduce costs, enabling fintechs to offer services at lower prices.

This back-end technological shift is fundamental to the front-end user experience, ensuring that digital wallets and payment apps are reliable, fast, and capable of handling the ever-increasing volume of cashless transactions.

10. Financial Inclusion Reaches the Underserved

A defining trend of Asia’s cashless revolution is its power to drive financial inclusion. Fintech companies are innovating to serve unbanked and underbanked populations through microfinance, peer-to-peer lending, and user-friendly digital wallets . The proliferation of affordable smartphones has enabled this shift, bringing digital financial services to rural and low-income communities for the first time.

By leveraging alternative data for credit scoring and offering low-fee micro-transactions, fintech is unlocking economic participation for millions, ensuring the cashless revolution leaves no one behind.

| Trend | Key Technologies | Primary Impact |

|---|---|---|

| AI-Powered Finance | Deep Learning, Predictive Analytics | Hyper-Personalization & Fraud Prevention |

| Interconnected Payments | API Gateways (e.g., Nexus) | Frictionless Cross-Border Transactions |

| Super Apps | Integrated Platforms, APIs | Seamless Embedded Financial Services |

| CBDCs | Blockchain, Digital Ledgers | State-Backed Digital Cash & Efficiency |

| Cloud Infrastructure | Cloud-Native Platforms | Scalable, Secure & Cost-Effective Services |

Regional Spotlight: Diverse Paths to a Cashless Future

Asia’s journey to cashless is not uniform; each region showcases a unique model. China remains the undisputed titan, with digital wallets like Alipay and WeChat Pay accounting for 84% of all e-commerce payments . Its success is a blueprint of ecosystem building, where payments are embedded into social and commercial platforms.

India is experiencing a government-led revolution through its Unified Payments Interface (UPI), which now accounts for nearly 60% of all point-of-sale transactions . This public infrastructure, combined with a booming fintech talent pool focused on AI and compliance, positions India for explosive growth .

In Southeast Asia, nations like Thailand, Singapore, and Indonesia are leveraging national instant payment systems (PromptPay, PayNow, QRIS) and pioneering cross-border linkages . However, the region faces a funding slowdown, with capital consolidating around mature hubs like Singapore, which captured 84% of regional fintech funding in 2025 . This creates a dual narrative of rapid technological progress alongside financial constraints for early-stage startups.

Meanwhile, mature markets like Hong Kong face a unique “cashless deadlock.” Despite having advanced technology like the Faster Payment System (FPS), adoption among SMEs remains low due to fragmented systems, high transaction fees, and regulatory challenges, causing the city to lag behind its neighbors .

Conclusion: The Inexorable March Forward

The cashless revolution in Asia is an irreversible force, propelled by a powerful synergy of technology, regulation, and market demand. By 2026, the trends of AI personalization, interconnected payment systems, and embedded finance will have moved from the fringe to the foundation of daily economic life. The transition is about more than just convenience; it’s about building a more inclusive, efficient, and secure financial ecosystem for hundreds of millions of people. While challenges like regulatory harmonization and cybersecurity remain, the trajectory is clear. The future of finance in Asia is digital, and it is arriving faster than we ever imagined.

Read Also: The Cashless Revolution – How Fintech is Reshaping Everyday Life in Pakistan 2026

Frequently Asked Questions (FAQs)

1. Which Asian country is leading the cashless revolution?

China is currently the leader in terms of market penetration and scale, with digital wallets like Alipay and WeChat Pay dominating the landscape. However, India is experiencing the fastest growth, driven by its government-backed UPI system, which is projected to power 76% of POS transactions by 2030 .

2. How is artificial intelligence (AI) used in fintech?

AI is used extensively to enhance security and user experience. Key applications include fraud detection through deep learning algorithms that spot anomalous transactions, AI-powered chatbots for customer service, and predictive analytics to offer personalized financial product recommendations .

3. Are cross-border payments within Asia becoming easier?

Yes, significantly. Central banks across ASEAN are actively linking their national instant payment systems. Projects like the Nexus Global Payments (NGP) gateway are working to create a multilateral network that will allow for seamless, instant, and low-cost cross-border transactions, with the first live transactions expected around 2027 .

4. What is a Central Bank Digital Currency (CBDC)?

A CBDC is a digital form of a country’s fiat currency, issued and regulated by its central bank. China’s digital Yuan (DCEP) is a leading example. Unlike cryptocurrencies, CBDCs are centralized and designed to be a stable and secure digital equivalent of cash .

5. Will cash become completely obsolete in Asia?

While cash usage is plummeting, it is unlikely to disappear entirely in the near future. In markets like Japan and among older demographics, cash remains popular. The more probable outcome is a hybrid system where cash coexists with a diverse array of digital payment options, though its share of transactions will continue to decline .

6. What are the biggest challenges facing the cashless revolution?

Key challenges include cybersecurity threats, a complex and sometimes inconsistent regulatory environment across different countries, and ensuring financial literacy and access in rural or underserved populations .

7. How does the cashless trend benefit small businesses?

Digital payments reduce the costs and risks associated with handling physical cash. Integrated systems and unified QR codes lower transaction fees and simplify operations. Furthermore, connection to cross-border networks allows even small merchants to easily accept payments from international tourists, opening up new revenue streams .

2 thoughts on “Top 10 Fintech Trends Driving the Cashless Revolution in Asia 2026”