Pakistan stands at a pivotal moment in its energy history, with 2026 shaping up to be a landmark year in its transition toward renewable resources. The country is currently experiencing what analysts describe as a “perfect storm” of market conditions, policy developments, and technological advancements that are rapidly transforming its energy landscape . This transformation is not merely climate-driven but represents what one report characterizes as “a counter-infrastructure of necessity” that has expanded access at a pace unimaginable through conventional planning . From negligible solar penetration just a few years ago, Pakistan is now projected to source approximately 20% of its electricity from solar power alone by 2026 , with renewables overall accounting for more than half of installed capacity .

The journey toward 2026 represents a critical implementation phase for Pakistan’s broader renewable energy ambitions. With the government’s formal approval of the Alternative and Renewable Energy Policy 2019, which aims to boost the share of electricity generated from renewable sources to 20% by 2025 and 30% by 2030, the coming year will serve as a crucial test of the country’s ability to meet these targets . This article provides a comprehensive analysis of Pakistan’s renewable energy sector, examining both the tremendous opportunities and significant challenges that will define its trajectory in 2026 and beyond.

Table of Contents

The Current Energy Landscape in Pakistan

Pakistan’s energy sector has traditionally been dominated by fossil fuels, with significant imports of liquefied natural gas (LNG) and oil contributing to both energy insecurity and a substantial economic burden. The country continues to grapple with circular debt in the power sector, which stood at Rs600 billion in 2024 but had been reduced to Rs397 billion in 2025, with further improvements expected . This debt accumulation stems from multiple factors, including transmission losses exceeding 20%, electricity theft, and mandatory capacity payments to underutilized power plants .

The renewable energy sector, while growing rapidly, currently represents a relatively small portion of Pakistan’s overall energy mix. According to recent data, renewable energy accounts for just 7% of Pakistan’s total energy consumption, highlighting the significant progress still needed to meet national targets . However, this statistic obscures the remarkable pace of change, particularly in distributed solar generation, which has fundamentally altered the dynamics of the power sector.

| Energy Source | Projected Capacity (MW) | Percentage of Total |

|---|---|---|

| Hydropower | 11,853 MW | 27% |

| Solar (Net Metering) | 7,794 MW | 18% |

| Solar (Other) | 650 MW | 1% |

| Coal | 7,920 MW | 17% |

| RLNG | 6,493 MW | 15% |

| Nuclear | 3,545 MW | 8% |

| Wind | Not specified | Not specified |

| Gas | 2,776 MW | 6% |

| Oil | 1,351 MW | 3% |

| Bagasse | 399 MW | 1% |

By June 2026, Pakistan’s total installed generation capacity is projected to reach 44,626 MW, with renewable sources (including hydropower) accounting for 50.5% and thermal sources making up the remaining 49.5% . This represents a significant milestone—the first time renewables will constitute the majority of installed capacity in Pakistan’s history.

Solar Power: Pakistan’s Renewable Energy Revolution

The most dramatic transformation in Pakistan’s energy sector has undoubtedly occurred in solar power. What began as modest adoption under a 2015 incentive program has turned into a mass phenomenon, with households, businesses, and farmers rapidly turning to solar installations . The growth has been so substantial that solar power is projected to become Pakistan’s second-largest source of power generation by June 2026, trailing only hydropower .

This solar boom resulted from what researchers describe as a “perfect storm” of supply and demand factors . On the demand side, an unprecedented hike in electricity tariffs—up 155% in just three years—rendered grid power unaffordable for many consumers and businesses . Simultaneously, on the supply side, global solar panel prices fell by nearly 50% due to Chinese manufacturing overcapacity, while Pakistan exempted solar photovoltaic (PV) imports from duties and sales taxes until mid-2025 . The combination made rooftop solar systems financially attractive for a growing segment of the population.

The agricultural sector has emerged as a particularly significant adopter of solar technology. Of the 1.5 million to 2 million tube wells nationwide, approximately 80% previously relied on imported diesel units unconnected to the grid . As diesel became more expensive with the removal of subsidies, solar pumps became increasingly cost-effective. Experts now suggest that half of all tube wells will switch to solar power, adding 5.6 GW to 7.5 GW of distributed PV capacity—equivalent to 1 million U.S. residential rooftop solar systems .

Harnessing the Wind: Pakistan’s Untapped Potential

While solar power has captured much of the attention in Pakistan’s renewable energy narrative, the country also possesses substantial wind resources that remain largely untapped. Pakistan’s wind energy potential is estimated at a massive 350 GW, with about 120 GW considered feasibly exploitable after accounting for land and turbulence constraints . The most promising wind resources are concentrated in the Gharo-Jhimpir wind corridor in Sindh, which alone covers an area of 9,700 square kilometers with a gross wind power potential of 43,000 MW .

The wind energy market in Pakistan is projected to register a compound annual growth rate (CAGR) of greater than 5% during the forecast period (2025-2030) . As of 2022, Pakistan had 26 operational wind power projects with a cumulative capacity of 1,335 MW connected to the national grid, with a further ten wind power projects totaling 510 MW capacity under construction . International companies including Vestas Wind Systems AS, General Electric Company, and Goldwind International Holdings Ltd are already active in the market, indicating international confidence in Pakistan’s wind energy potential .

Technology improvements have been a significant driver of wind energy growth globally, and Pakistan stands to benefit from these trends. According to the International Renewable Energy Agency (IRENA), onshore wind energy has become one of the cheapest sources of electricity generation globally, with the average cost of electricity generation through onshore wind energy at USD 0.039/kWh in 2020 . As technology continues to improve and costs decline, Pakistan’s abundant wind resources represent a substantial opportunity for clean energy expansion.

Hydropower: The Bedrock of Pakistan’s Renewable Energy

Hydropower has long been the cornerstone of Pakistan’s renewable energy landscape, and it continues to play a vital role in the country’s energy transition. As of June 2026, hydropower is projected to remain Pakistan’s largest source of electricity generation, with an installed capacity of 11,853 MW, representing 27% of total installed capacity . The sector continues to grow, with 135 MW of new hydropower capacity expected to be added to the system in FY2025-26 .

Several major hydropower projects are currently in development that will significantly boost Pakistan’s clean energy capacity in the coming years. These include:

- Bunji Hydropower Project: A 7,100 MW project in Gilgit-Baltistan, being developed by China Three Gorges, with an expected commercial operation date of 2030

- Diamer Basha Dam: A 4,500 MW project currently under construction, expected to be commissioned by 2029

- Dasu Hydropower Project: A 4,320 MW project currently under construction, expected to be commissioned by 2026

- Tarbela Hydropower Project: A 6,418 MW project that is partially active and continues to be developed

These projects not only contribute to Pakistan’s energy security but also play a crucial role in water management, irrigation, and climate resilience. However, hydropower development also faces challenges, including transboundary water tensions with India over the Indus Treaty, which deteriorated in Kashmir in early 2025 . The situation demonstrates water’s critical role in regional diplomacy and highlights the importance of dialogue on transboundary water cooperation.

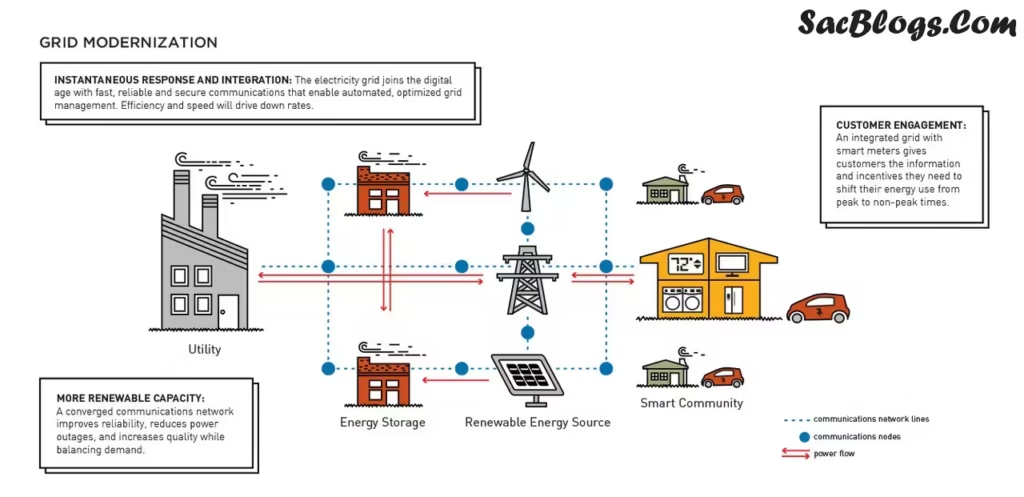

Energy Storage and Grid Modernization: Critical Enablers

As Pakistan’s renewable energy capacity grows, the importance of energy storage and grid modernization becomes increasingly critical. The country is already witnessing a rapid uptake in battery energy storage systems (BESS), with imports of lithium-ion batteries growing significantly alongside solar PV imports . In 2024 alone, Pakistan imported an estimated 1.25 GWh of lithium-ion batteries, and a further 400 MWh in January and February of 2025 .

This surge in battery storage adoption is driven by compelling economics. According to the Institute for Energy Economics and Financial Analysis (IEEFA), even with taxes and customs duties adding 48% to battery import costs, home systems offer a payback period of three to five years, with commercial and industrial setups paying for themselves in four to six years . Falling costs of both solar and battery technology, combined with rising electricity prices, have created favorable conditions for storage adoption.

The national grid requires significant modernization to accommodate the changing energy landscape. By June 2026, the transmission sector is planned to be boosted by an additional 5,550 MVA, 4,710 MVA, and 1,300 MVA capacity on 500kV, 220kV, and HVDC grids, respectively . Transmission lines on these voltage levels will be extended by 170 km (500kV), 355 km (220kV), and 137 km (±660kV) . These investments are essential for managing the more variable and distributed nature of renewable energy generation.

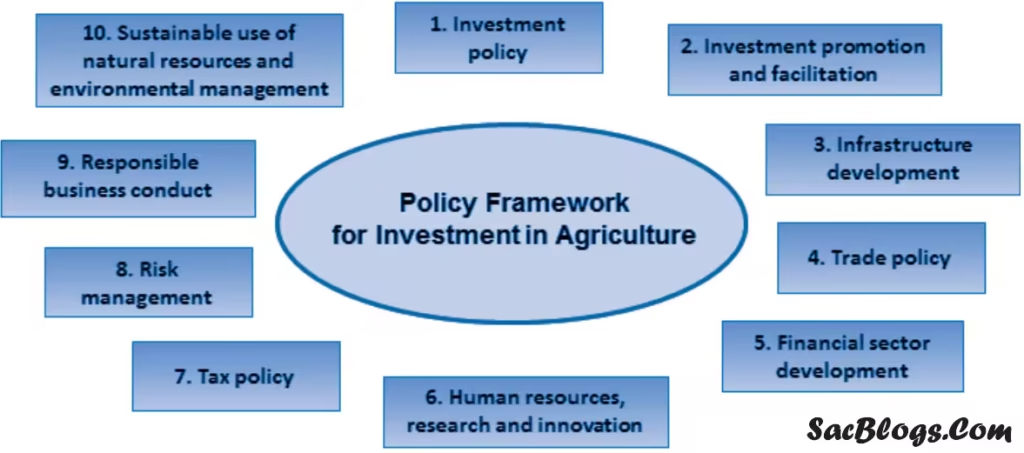

Policy Framework and Investment Opportunities

Pakistan’s renewable energy transition is supported by a evolving policy framework designed to encourage investment and development. The cornerstone of this framework is the Alternative and Renewable Energy Policy 2019, approved in August 2020, which aims to boost the share of electricity generated from renewable sources to 20% by 2025 and 30% by 2030 . The policy includes various incentives for renewable energy development, including tax breaks and streamlined approval processes.

In a significant market reform, the government has announced plans to open Pakistan’s electricity market starting in January 2026, allowing consumers using one megawatt or more to choose their power suppliers for the first time in the country’s history . This move toward competitive markets is intended to introduce competition and ensure fairer prices for consumers, potentially accelerating the adoption of renewable energy by large consumers.

Investment requirements for Pakistan’s renewable energy transition are substantial. The country’s revised Nationally Determined Contribution (NDC) commits to increasing renewable energy to 60% of the energy mix by 2030, which would require an estimated USD 100 billion by that year . This creates significant opportunities for both domestic and international investors across the renewable energy value chain.

The government has actively showcased potential investment opportunities in the energy sector, including wind energy, in international forums such as the Pakistan-Austria Investors meet-up in March 2022 . These efforts to attract foreign investment with additional facilities and tax breaks are crucial for bringing the necessary capital and expertise to scale up Pakistan’s renewable energy infrastructure.

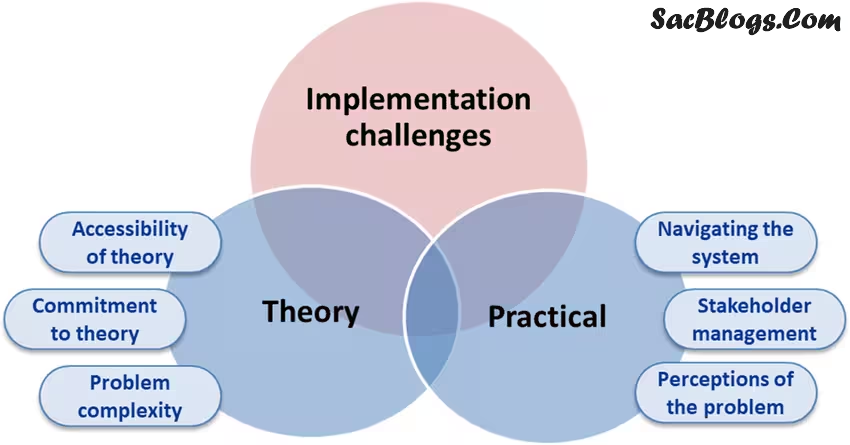

Challenges and Barriers to Implementation

Despite the promising outlook, Pakistan’s renewable energy transition faces several significant challenges that could impede progress toward its 2026 targets. One of the most pressing issues is the potential utility death spiral, where distributed solar reduces grid demand, causing revenues to collapse as high-paying consumers defect . Electric companies, already plagued by 20% transmission losses and endemic theft, face financial instability as their customer base erodes .

The circular debt problem in the power sector remains a persistent challenge, though it has shown recent improvement, decreasing from Rs600 billion in 2024 to Rs397 billion in 2025 . This debt is exacerbated by the country’s commitments to capacity payments for underutilized fossil-fuel plants, particularly those developed under the China-Pakistan Economic Corridor partnership . As more high-paying consumers defect to solar, remaining grid users face ever-increasing electricity rates to cover these fixed costs, creating a vicious cycle that further incentivizes defection.

Grid integration presents another significant challenge. The variable nature of solar and wind generation requires substantial upgrades to grid infrastructure and management practices. The government is considering reducing net metering payments for excess solar electricity injected into the grid, but such a move could further incentivize the purchase of batteries, potentially accelerating the grid exodus and exacerbating integration challenges .

Finally, policy uncertainty and coordination problems between different levels of government create headwinds for renewable energy development. As central and provincial policies sometimes act at cross-purposes—with provincial authorities promoting agricultural solarization while the federal government considers import taxes to stabilize revenues—these contradictions may push more consumers toward off-grid systems, accelerating the fragmentation of the power sector .

Conclusion: The Path Forward for Renewable Energy in Pakistan

As Pakistan looks toward 2026, the country’s renewable energy transition represents both an unprecedented opportunity and a formidable challenge. The remarkable growth of solar power, the vast potential of wind energy, and the consistent contribution of hydropower collectively position Pakistan to achieve a significant milestone—with renewables projected to account for 50.5% of installed capacity by June 2026 . This transition offers the promise of greater energy security, reduced dependence on expensive imported fuels, and expanded electricity access for marginalized communities.

However, realizing this potential will require thoughtful navigation of the complex challenges surrounding grid modernization, utility finances, and policy coordination. The government must strike a delicate balance between encouraging distributed generation and maintaining the financial viability of the grid, potentially through innovative rate structures, targeted investments in modernization, and reforms to the capacity payment system. The planned opening of the electricity market in January 2026 represents a step in the right direction, introducing competition that could benefit consumers and drive efficiency .

Looking beyond 2026, Pakistan’s renewable energy transition promises benefits that extend far beyond the energy sector itself. The decentralized nature of solar adoption has already fostered new skills, livelihoods, and forms of collective learning, with a new wave of mostly self-taught solar entrepreneurs building hyperlocal supply chains that extend into Pakistan’s interior lands . These developments suggest that Pakistan’s renewable energy journey—though born of necessity—could evolve into a foundation for broader economic and social renewal, offering a model for other developing nations pursuing their own energy transitions.

Read Also: Top 10 Solar Energy Solutions for Homes and Businesses in Pakistan 2026

FAQs About Renewable Energy in Pakistan

1. What percentage of Pakistan’s energy currently comes from renewable sources?

Renewable energy (excluding large hydropower) currently accounts for approximately 7% of Pakistan’s total energy mix . However, with the rapid growth of solar power and continued hydropower development, renewables are projected to reach 50.5% of installed capacity by June 2026 .

2. Why has solar power become so popular in Pakistan so quickly?

Solar power adoption has surged due to a “perfect storm” of factors: electricity tariff hikes of 155% over three years, a nearly 50% reduction in global solar panel prices, tax exemptions on solar imports, and favorable net-metering policies that allow consumers to sell excess power back to the grid .

3. What is Pakistan’s potential for wind energy development?

Pakistan has enormous wind energy potential, estimated at 350 GW total, with about 120 GW considered feasibly exploitable. The Gharo-Jhimpir wind corridor in Sindh alone has a potential of 43,000 MW, while Balochistan shows particular promise with an estimated 146 GW of potential .

4. How is Pakistan addressing the challenge of renewable energy storage?

Pakistan is already witnessing rapid uptake in battery energy storage systems, importing 1.25 GWh of lithium-ion batteries in 2024 alone. Even with import duties, these systems offer attractive payback periods of 3-5 years for homes and 4-6 years for commercial setups .

5. What are “capacity payments” and how do they affect electricity prices?

Capacity payments are fixed, dollar-denominated payments that Pakistan must make to power plants (including underutilized fossil fuel plants) regardless of whether they generate electricity. These payments contribute significantly to electricity costs, with each unit of grid power including around Rs14 in capacity charges .

6. What policy supports has the government implemented for renewable energy?

The key policy is the Alternative and Renewable Energy Policy 2019, which aims to achieve 20% renewable energy by 2025 and 30% by 2030. Additional supports have included tax exemptions on solar panel imports until mid-2025 and net-metering policies that compensate solar users for excess power .

7. How reliable is solar power during monsoon seasons or cloudy weather?

While solar generation decreases during cloudy weather, Pakistan has among the highest levels of solar irradiance in the world, providing strong generation potential throughout most of the year. The growing adoption of battery storage systems also allows users to store solar energy for use during cloudy periods or at night .

8. What major hydropower projects are expected to be operational by 2026?

The 4,320 MW Dasu hydropower project and the 4,866 MW Thakot project are both expected to be commissioned by 2026. The 4,500 MW Diamer Basha Dam is scheduled for completion by 2029 .

9. How is Pakistan’s renewable energy transition creating economic opportunities?

The solar boom has fostered a new wave of solar entrepreneurs, technicians, and installers who have developed hyperlocal supply chains. These developments have created exportable skills, with Pakistani solar technicians now finding opportunities abroad .

10. What is the “utility death spiral” and how does it affect Pakistan?

The “utility death spiral” occurs when distributed solar reduces grid demand, causing utilities to raise prices, which in turn incentivizes more consumers to adopt solar. This creates a vicious cycle that threatens the financial viability of the grid, particularly in Pakistan where utilities already face significant transmission losses and theft .

1 thought on “Future of Renewable Energy in Pakistan 2026: Opportunities and Challenges”